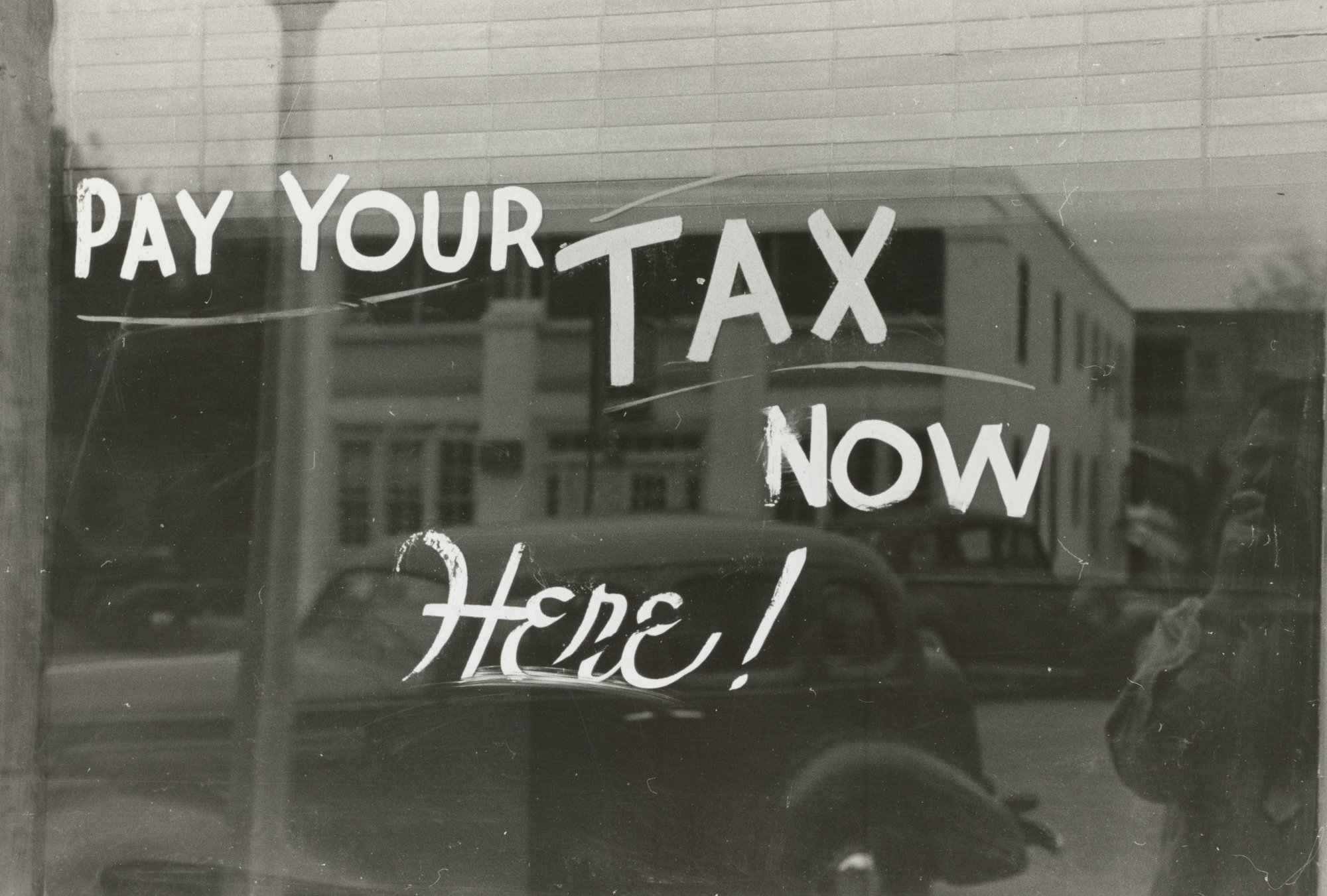

Your Home Tax Deduction Checklist

Posted by The Cobb Group on

Welcome to your home tax deduction checklist! For homeowners, this kind of guidance is essential in the wake of all the changes ushered in by the new tax plan, the Tax Cuts and Jobs Act, that are still rolling in.

The biggest change for 2021? The standard deduction jumped a couple of hundred dollars for taxpayers—to $12,550 for individuals, $18,800 for heads of household, and $25,100 for married couples filing jointly. And this higher number means you need to dig into all of your home expenses to see if their total sum tops the standard deduction, depending on your filing status. (If the total doesn’t surpass it, then you’ll just take the standard deduction on your taxes when you file.)

To help, here’s a list of all the tax breaks for…

266 Views, 0 Comments

You can’t shock your loan officer. They’ve heard it all before. Count on the fact that your loan officer has answers to all the uncomfortable mortgage questions you may be too afraid to ask. Itchy topics like getting a home loan with no job, taking an ex off your mortgage after divorce, and filing for bankruptcy aren’t as scary as you think.

You can’t shock your loan officer. They’ve heard it all before. Count on the fact that your loan officer has answers to all the uncomfortable mortgage questions you may be too afraid to ask. Itchy topics like getting a home loan with no job, taking an ex off your mortgage after divorce, and filing for bankruptcy aren’t as scary as you think.